Healthcare Providers

AUTO MEDICAL RECEIVABLES & CASH FLOW SOLUTIONS FOR HEALTHCARE PROVIDERS, HOSPITAL, AND HEALTHCARE SYSTEMS PAYING YOU NOW, NOT LATER

RATHER THAN LETTING YOUR ACCOUNT RECEIVABLES AGE AND LOSE VALUE OVER TIME, ENGAGE OGRATIS TO BUY THEM FROM YOU, TO ALLOW YOU TO FOCUS ON YOUR CORE COMPETENCIES, WHILE PROVIDING YOU RECURRING CASH PAID UP-FRONT EACH PERIOD, AND ADDED VALUE THROUGH YOUR ENTIRE REVENUE CYCLE.

OGRATIS ENABLE YOU TO GET THE HIGHEST PAYOUT IN THE INDUSTRY FOR YOUR ACCOUNT RECEIVABLES WITH SEVERAL OTHER ADDITIONAL BENEFITS

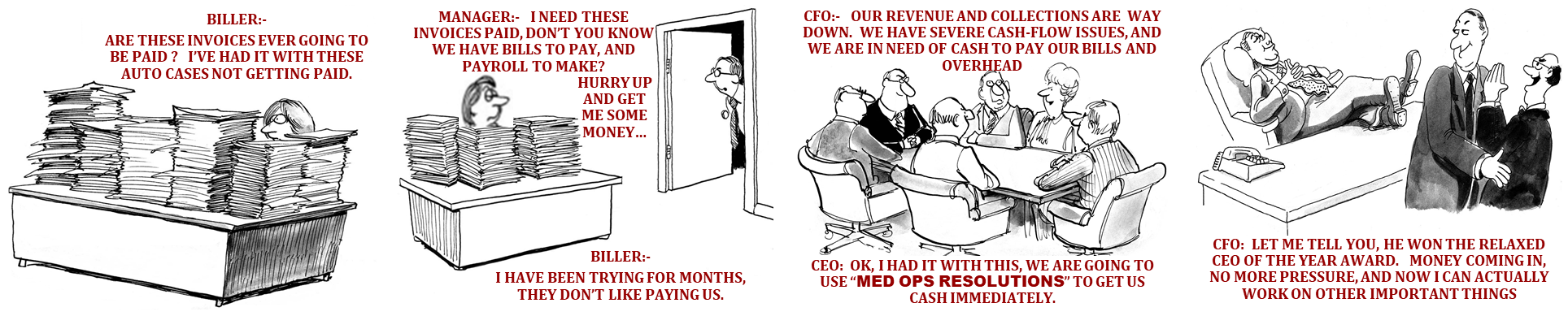

Can your organization afford to wait years for reimbursement of lien-based accounts receivable funds? Do you really want to increase your Average Days Out and shoulder the overhead, while taking significant reductions, or hoping that a court case will be decided in your favor? And potentially collecting nothing? Let alone lose track of the cases and end up writing them off.

Very few hospitals, doctors, medical practice, and healthcare organizations can afford to go this route – and that’s why so many are apprehensive of accepting personal injury auto patients.

Ogratis enables you to get the highest payout in the industry for your auto medical account receivables, as we do not cherry pick cases from your portfolio.

As long as the case is open and less than three years old we will accept them. You continue to have a voice in the manner in which your personal injury cases are settled and maintain your relationship with the referring attorney.

Other funders remove you from this process, which can have a detrimental impact on your relationship with the attorneys, physicians, and other referral sources.

Finally, our program maintains the total gross value of your services and ensures that the full amount of your bill remains outstanding against the case. For personal injury cases this is a critical element for the plaintiff’s attorney.

YOUR ACCOUNT RECEIVABLES ARE YOUR ASSETS

As a medical provider, your biggest asset is your accounts receivable, especially the payments you expect to receive from auto insurance companies, personal injury attorneys, or settlements. Unfortunately, due to the current inadequacies and bureaucratic nightmares with our auto laws and auto insurance companies, and the deny and delay tactics played by them, a medical provider has to wait months and years to monetize this asset (collect on their invoices). That common phenomena hinders the provider’s ability to conduct ordinary business, process payroll, order supplies, pay rent/taxes, build the next practice, remodel, reinvest, and be able to grow your business.

CONTINUE ACCEPTING & SERVICING AUTO INJURY PATIENTS, KNOWING OGRATIS WILL PAY YOU RIGHT AWAY

Accounts receivable financing from Ogratis will enable your organization to accept and happily service auto injured patients, knowing you will get reimbursed quickly and your risk is low.

With Ogratis, your organization can help the victims of personal injury accidents get the care they need knowing Ogratis will purchase the personal injury invoices and provide quick approval and funding of these account receivables and invoices ongoing, everybody wins.

YOUR COST VS. PROFITS VS. RISK

Reduce your risk in an environment where an increasing number of refusals and delays in payments for auto cases, other insurance agencies are making cutbacks, you need a competitive edge and strategic partnership with Ogratis, to enables you to accept patients that you may have otherwise refused and attract surgeons or other healthcare professionals that may not have be part of your organization in the past.

Reduce your cost by letting us take all of the administrative, billing and collection functions associated with these receivables off your hands.

Our accounts receivable financing will help your organization save time and money, while collecting timely and risk free.

MAINTAIN YOUR POSITIVE CASHFLOW FOR SUCCESSFUL BUSINESS

Most medical providers turn to their local banks for working capital loans, but most of these banks have limits, strict requirements and burdens that make it difficult to obtain these loans/funds.

Some banks don’t want to lend against A/Rs while others only focus on large medical providers with substantial history, perform background checks, request sensitive financial information, etc.

Luckily, providers have other simpler cash-flow options – Ogratis

LET US TURN YOUR AGING RECEIVABLES INTO CASH! AS WELL AS, ALL YOUR FUTURE RECEIVABLE ON AN ONGOING BASIS. WE PURCHASE PERSONAL INJURY MEDICAL RECEIVABLES FROM THE FOLLOWING HEALTHCARE PROVIDERS’ & SPECIALTIES.

- Hospital & Healthcare Systems

- Surgical & Trauma Centers

- Orthopedics & Surgeons

- Neurology & Neurosurgery

- Spine Surgeons & Specialists

- Pain Management & Rehabilitation

- Tbi Treatment Centers

- Anesthesia

- Chiropractic Care

- Diagnostic & Imaging Centers

- Physical Therapy & Rehab Centers

- Toxicology Labs

- Pharmacies & Infusion Centers

- Durable Medical Equipment

- Home Health/Private Duty

- Medical & Non-medical Transportation

- Others:

WHY MEDICAL PROVIDERS FACE HIGH RISK WITH AUTO CASES?

- Medical providers do NOT get paid until the legal cases are tried/won or settled, which is “VERY RISKY”.

- Most of the time, cases are settled without the medical provider’s consent or knowledge, taking up to 1-3 years to collect.

- Some legal cases are LOST resulting in ZERO payment to medical provider.

- Upon case settlement, lawyers often ask the medical provider to take a large reduction, which places HUGE financial pressure on the medical provider.

GOOD NEWS – OGRATIS WILL REMOVE SUCH RISK AWAY FROM YOU

LET’S INTRODUCE YOU TO OGRATIS, AND THE VALUE WE BRING:

- Ogratis will lead and facilitate the entire transaction/process, making it easy and painless from start to finish.

- Ogratis will take the noise away, allowing your biller to focus on traditional insurance claims, and other crucial aspects of your business/practice.

- Ogratis will help you achieve healthier cash-flow and improved profits.

- Ogratis will NEVER ask for your personal/business SSN, Tax Returns, P&L/IS, or other financial information.

- Ogratis will provide you local support to work-directly with your existing staff, billers and/or attorneys, while safe-guarding all your existing auto referral sources.